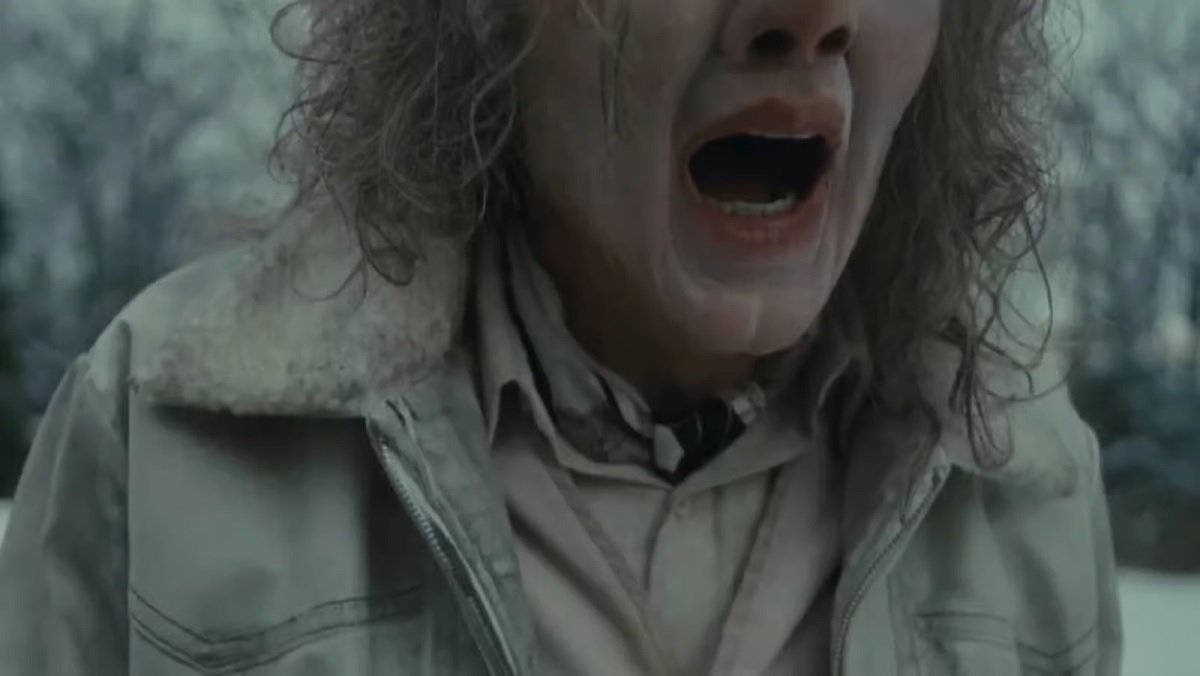

The current state of horror means we’re getting a deluge of films trying to outdo each other in sending chills up the spine. This has resulted in some of the most interesting and risk-taking movies in the genre. While A24’s plaudits for “elevated horror” are fairly passé at this point, I think NEON are the ones releasing just as heady scary films but with a far more sinister edge, often much more my speed. Their latest is Osgood Perkins’ Longlegs, which has had one of the most striking ad campaigns in decades. The movie, I’m happy to report, is just as striking.

I’m glad I didn’t have to write this review within the first day or even the first few days after seeing Longlegs. If I had, I would have likely given the impression I didn’t like it, or at least that I didn’t think it was as good as people said. Comparing any movie to Silence of the Lambs is bold to say the least. As a serial killer FBI procedural, Longlegs is not particularly complicated. Many aspects of the investigation are supremely obvious, others completely out of left field. But as a horror movie, as an exploration of creeping dread and occult uncanniness, Longlegs burrows under your skin and stays there for weeks.

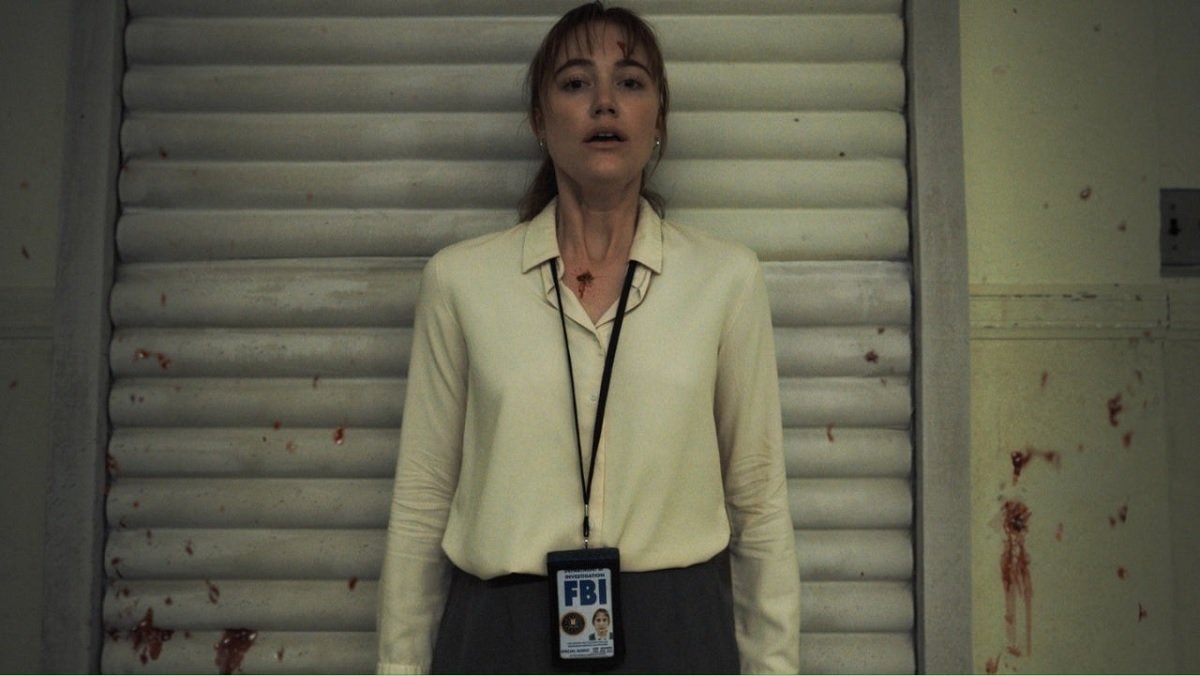

The basic story follows newly minted Oregon field agent Lee Harker (Maika Monroe) as she uses her inexplicable intuition to aid Special Agent Carter (Blair Underwood) in one of the Bureau’s most baffling cases. Several completely unrelated men have killed their entire families and themselves over the past several decades. No physical evidence suggests any other person took part. However, each crime scene had a letter written in strange symbols, signed “Longlegs.”

It won’t give anything away to say Nicolas Cage plays the titular Longlegs, and his appearance is so upsetting they won’t show it in ads. It takes a while for the movie to show him, too. While we know this, who exactly Longlegs is, what he does, and how he does it are the real mysteries at the film’s heart. Harker delves deeper into the strange occult circumstances of these massacres, her own connections come to the surface as the inevitability of Longlegs’ masterplan begins to take shape.

Perkins’ directing style and passion for slow and creeping dread in his movies pays off big time in Longlegs. However, unlike some of his more languorous outings, here he punctuates the moody quiet with loud and shocking moments. It constantly keeping the audience nervous about what will come next. For the first two-thirds of the movie, I sat completely wrapt in squinting, white-knuckle anxiety about what might lurk in the corners of the slightly fisheyed frame. What terror could hide in the shadow just behind Harker?

The last third is a different matter. I liken the experience of watching Longlegs to watching Hereditary for the first time. The movies are quite different, but both of their climaxes mixed terror with puzzlement in me. Some of the plot is so obvious I assume there must be something more. Other parts are legitimately silly. So much so that when everything falls into place I thought, “Wait, this is what the movie’s doing?” In both cases my brain got in the way of my body’s reaction to what I was watching. Parts of Longlegs feel so at odds with the rest of it. It contains moments of humor I’m not entirely sure were intentional. People next to me at the screening laughed uproariously toward the end. I can’t decide if they were laughing at or with the movie.

However, and I hate to advocate for turning off your brain when watching anything, Longlegs is a vibes movie first and foremost. It’s not a crime movie with horror elements, it’s a weird horror movie with the FBI. Perkins, I think (I hope) understands what scares us about occultism is also pretty goofy. This is why I’m happy I got to sit with the movie before writing this. Initially I was prepared to say it looks good, that Underwood’s performance is tremendous, but that it’s trying to get by too much on Cage’s creepy look and strangely mannered performance. And now? I just go “yeah, of course it does. That’s why it’s awesome!”

I think Longlegs is a legitimately superb example of a horror movie that knows what it’s doing, knows it’s playing in a very tamped-down sandbox, and uses that to thoroughly unsettle and affect the audience. Tight plotting be damned, this movie’s got moxy! The next dozen times I watch it, I won’t care that the mystery isn’t anything special. It’s got those performances in that setting with those shocks. What more could you want?!

Longlegs opens in theaters July 12.

Kyle Anderson is the Senior Editor for Nerdist. He hosts the weekly pop culture deep-dive podcast Laser Focus. You can find his film and TV reviews here. Follow him on Instagram and Letterboxd.